Image source: The Motley Fool.

Trupanion Inc (NASDAQ:TRUP)Q4 2018 Earnings Conference CallFeb. 13, 2019, 4:30 p.m. ET

Contents: Prepared Remarks Questions and Answers Call Participants Prepared Remarks:

Operator

Greetings and welcome (inaudible) Fourth Quarter and 2018 (inaudible) this time all (inaudible) (Operator Instructions) This conference (inaudible). I would now like to turn to your host Laura Bainbridge, (inaudible) Relations.

Laura Bainbridge -- Investor Relation Contact Officer

Good afternoon, and welcome to the Trupanion Fourth Quarter 2018 Financial Results Conference Call. Participating on today's call are Darryl Rawlings, Chief Executive Officer; and Tricia Plouf, Chief Financial Officer.

Before we begin, I would like to remind everyone that during today's conference call we will make certain forward-looking statements regarding the future operations, opportunities and financial performance of Trupanion within the meaning of the Safe Harbor provision of the Private Securities Litigation Reform Act of 1995.

These statements involve a high degree of known and unknown risks and uncertainties that could cause actual results to differ materially from those discussed. A detailed discussion of these and other risks and uncertainties are included in our earnings release, which can be found on our Investor Relations website, as well as the company's most recent reports on forms 10-K and 8-K filed with the Securities and Exchange Commission.

Today's presentation contains references to non-GAAP financial measures that management uses to evaluate the company's performance, including without limitation, fixed expenses, variable expenses, adjusted operating income, acquisition cost, adjusted EBITDA and free cash flow. When we use the term adjusted operating income or margin, it is intended to refer to our non-GAAP operating income or margin before new pet acquisition. Unless otherwise noted, margins and expenses will be presented on a non-GAAP basis, which excludes stock-based compensation expense and depreciation expense.

These non-GAAP measures are an addition to, and not a substitute for, measures of financial performance prepared in accordance with the U.S. GAAP. Investors are encouraged to review the reconciliations of these non-GAAP financial measures to the most directly comparable GAAP results, which can be found in today's press release or on Trupanion's Investor Relations website under the Quarterly Earnings tab.

Lastly, I would like to remind everyone that today's call is also available via webcast on Trupanion's Investor Relations website. A replay will also be available on the site.

And with that, I'll hand the call over to Darryl.

Darryl Rawlings -- President, Chief Executive Officer and Director

Thanks, Laura. Good afternoon, everyone. 2018 was another consistent year at Trupanion. Revenue was up 25%, adjusted operating income grew 36% and we calculated our internal rates of return on our pet acquisition spend to be on the high end of our 30% to 40% target for an average pet.

Every year and for the foreseeable future, our goals are to grow revenue 20% to 30% year-over-year, expand our adjusted operating income and reinvest as much of it as possible within our target internal rates of return of 30% to 40%.

Achieving these three measures, we'll continuing to build the moats around our business and maintaining our culture of the markers of a successful year. And by these counts, 2018 was another good year. In 2018, we also moved the ball forward on our five key strategic initiatives, setting us up well for the long term. In some areas, we're further ahead than others, but, overall, I'm pleased with our progress.

Turning to our results in greater detail. 2018 revenues were $304 million and we ended the year with over 520,000 total enrolled pets. The pace of our pet acquisition accelerated in 2018 a trend that continued into the fourth quarter. Pet additions were particularly strong in Canada, where we've been operating for nearly 20 years.

Our accelerated growth in Canada, while maintaining strong retention rates, gives us continued confidence about our future in the U.S. market. Throughout 2018, our subscription business benefited from our strategic initiatives to grow same-store sales and improve conversion rates. In the fourth quarter specifically, growth benefited from the increased lead volume more than conversion.

Adjusted operating income or our profits from our existing book of pets was over $30 million. The pet acquisition team spent approximately $24 million of this to enroll over 120,000 new subscription pets.

As a reminder, we focus on the estimated internal rate of return of an average pet, when evaluating the effectiveness of our pet acquisition spend. We calculate this internal rate of return by understanding our cost to acquire an average new pet, and the operating profit that we anticipate will be generated over the pet's entire life.

As many of you will recall, I first discussed this concept in my 2014 annual shareholder letter and provided more detail again in 2017. We continue to believe this approach is the right way to think about the effectiveness of pet acquisition spending and a more precise measure than LVP, since it includes both our fixed expenses as well as a capital charge.

In 2018, we scaled our adjusted operating margin to 10.5%, making progress toward our long-term target of 15%. As adjusted operating income continues to grow, the challenge will be, how to continue to deploy this discretionary capital at our targeted internal rates of return.

We're encouraged by the progress the pet acquisition team made on this front in 2018, and believe the work we've done sets us up well for 2019.

In 2019, we aim to grow adjusted operating income to $40 million to $45 million. With these investable dollars, our pet acquisition team will continue to invest in our core channels, driving leads and improving conversions.

While our core channels will comprise the majority of our 2019 spend, we intend to be more aggressive in our test spend, which will include newer less proven tactics. These tests are important to our growth in future years and will remain a key part of our long-term strategy. We also plan to double down on our core competencies and chase our goal of Nirvana.

In 2019, we intend to add additional headcount and resources in departments found in both our fixed and variable expenses. Departments receiving significant investments in 2019, include our actuarial and data, legal and regulatory, software and IT, and our member experience teams.

I spent much of my time today talking about our subscription business. As a reminder, through our other business segment, we utilize our assets and expertise to add additional pets and revenue from business-to-business contracts and relationships. There will always be competing products in the marketplace, targeting alternative price points are being offered in alternative channels. Being involved with these other products gives us the freedom to remain focused on our high-quality medical insurance offered through the veterinary channel or sharing in the success of the broader category.

In addition to the near term, it is important that we are looking out five years, 10 years and 20 years. We need to ensure that we are expanding them both and building long-term cost-effective lead sources that will propel the growth of Trupanion for the decades ahead.

As a reminder, our moats or our Territory Partners and the face-to-face relationships they've build with veterinarians; our software, which enables our category-leading customer experience; and the data we have amassed to offer our value proposition fairly. Additionally, we will continue to invest in new products, channels and geographies.

We've made a number of those investments in 2018 and we look forward to updating you on our progress at our upcoming annual shareholder meeting. This year, our annual shareholder meeting will be held on June 6, again, at our Seattle headquarters.

Our team and culture are critical to our long-term success. This annual event is a terrific opportunity to meet the people behind Trupanion and gain access and insights from our key business leaders. Specific updates on our five key strategic initiatives will be discussed as well as a lengthy Q&A with the team. Additional details would be forthcoming on our Investor Relations website.

And with that I'll hand the call over to Trish.

Tricia Plouf -- Chief Financial Officer

Thanks Darryl and good afternoon everyone. As Darryl covered many of our 2018 financial highlights I'll focus my commentary on our fourth quarter performance, as well as provide our revenue outlook for the first quarter and full year of 2019.

Revenue for the fourth quarter was $82.6 million, up 24% year-over-year and led by strong pet enrollment in both our subscription and other business segments. Total enrolled pets increased 23% year-over-year to over 521,000 pets as of December 31.

Subscription revenue was $70.9 million in the quarter up 20% year-over-year. Total enrolled subscription pets increased 16% year-over-year to over 430,000 pets as of December 31. Pet growth within our subscription business benefited from increased leads in our core veterinary channel.

Monthly average revenue per pet for the quarter was $55.15, an increase of 4% year-over-year. In local currency, monthly average revenue per pet increased by 5% from the prior year for our U.S. members which is inline with our historical average of 5% to 6%.

In Canada, monthly average revenue per pet increased by 4% from the prior year for our members. Once again we have had accelerated growth in certain Canadian subcategories which are now more accurately priced to our target 70% value proposition, but have a lower average ARPU. You'll recall, we highlighted these trends last quarter.

Average monthly retention was 98.6% compared to 98.63% in the prior year period and ahead of our 10-year historical average of 98.5%. We're pleased to deliver relatively consistent rates of retention considering the continued acceleration in new pet enrollments through 2018.

As we have discussed, cancellations are highest in the first 90 days following a pet's enrollment which typically impacts retention rates in periods of accelerated new pet growth.

Our other business revenue which generally is comprised of our revenue that has a B2B component totaled $11.7 million for the quarter, an increase of 55% year-over-year. Year-over-year growth in our other business segment reflects an increase in the number of pets enrolled in this segment.

Total enrolled pets in this segment was approximately 90,500 at year-end compared to 51,500 at the end of the prior year. We currently estimate revenue growth in this segment to be between 20% to 25% in 2019. Subscription gross margin was 19% in the quarter within our annual target of 18% to 21%.

Total gross margin was 17% which includes our lower margin other business segment. For the quarter fixed expenses represented 6% of total revenue down from 8% in the prior year period, reflecting scale in our technology and general and administrative departments.

During the quarter, we recognized a full quarter's benefit from the purchase of our home office building in Seattle. Adjusted operating income totaled $9.1 million in the fourth quarter a 45% increase from the prior year period.

Net loss for the quarter was $0.3 million. As a percentage of revenue, adjusted operating margin expanded approximately 160 basis points year-over-year to 11%. We are pleased with the expansion in this margin particularly in the second half of the year.

Turning now to our acquisition costs. In the fourth quarter, we spent $6.6 million to acquire approximately 32,000 new subscription pets. This compares to the prior year period in which we spent $5.6 million to acquire approximately 27,000 subscription pets. We continue to be encouraged by our ability to deploy greater sums of our adjusted operating income to accelerate new pet enrollments at strong internal rates of return. Free cash flow after acquiring these pets was $2.6 million.

Operating cash flow in the quarter was $3.7 million, up from $3 million in the prior year period. Adjusted EBITDA was $2.6 million for the quarter, up from $0.7 million in the prior year period. Our net loss was $0.3 million or a $0.01 loss per basic and diluted share compared to a net loss of $0.8 million or a $0.03 loss per basic and diluted share in the prior year period. At December 31, we had $81.1 million in cash, cash equivalents and short-term investments and $12.9 million of long-term debt.

I'll now turn to our outlook for the first quarter and full year 2019. For the first quarter of 2019, revenue is expected to be in the range of $85.5 million to $86.5 million representing 23% year-over-year growth at the midpoint. Revenue for the full year 2019 is expected to be in the range of $368 million to $374 million, representing 22% year-over-year growth at the midpoint. Embedded in our revenue guidance for 2019 is ARPU growth in line with historical averages of 5% to 6%.

Also, please keep in mind that our revenue projections are subject to conversion rate fluctuations between the U.S. and Canadian currencies. For our first quarter and full year guidance, we used a 76% conversion rate in our projections which was the approximate rate at the end of January.

Thank you for your time today. And I will now turn the call back over to Darryl.

Darryl Rawlings -- President, Chief Executive Officer and Director

Thanks, Trish. We spent the bulk of our commentary today on our results. Before we open the call up for questions, I want to take a step back to briefly remind you of our mission and the reason that we exist. At our core, we want to help the pets we all love receive the best veterinary care possible. Pet owners love their pets. Responsible loving pet owners understand how to take care of them. We exercise them, play with them, feed them high-quality food and make sure they receive preventative healthcare. But where pet owners' struggle is how to budget for the cost of unexpected veterinary care when and if their pet becomes sick or injured.

First, pet owners don't know whether the pet is going to be lucky or unlucky. And second, the variance in cost between a lucky and unlucky pet is significant. Trupanion exist to help solve this problem. We offer pet owners the ability to budget for this care through a high-quality medical coverage provided for the life of their pet. Every day, we have nearly 600 pet passionate team members working in support of our mission. On site, you'll find over 200 dogs and cats reminding us why we come to work each day and the importance of what we do.

We are still in the very early innings of building Trupanion in this category. We are committed to building this business in a long-term and sustainable way. We'll continue to deepen our competitive moats and look forward to keeping you appraised of our progress. The first half of 2019 will provide several opportunities to do so. In just a few weeks, we'll be participating in the Bank of America Merrill Lynch Animal Health Summit in New York followed by the Raymond James Institutional Conference in Orlando.

As in past years, we'll be hosting an open Q&A session to follow the Berkshire Hathaway Annual Meeting on May 4th in Omaha. Berkshire Hathaway provides a great opportunity to meet with other long-term minded shareholders. I know we've met many of you there in prior years. And as I highlighted, we look forward to our 2019 Annual Shareholder Meeting on June 6th and hope to see many of you there.

And with that, I'll open the call up for questions.

Questions and Answers:

Operator

At this time, we will be conducting a question-and-answer session (Operator Instructions) Our first question comes from Andrew Cooper, Raymond James. Please proceed with your question.

Andrew Cooper -- Raymond James -- Analyst

Hey, guys. Thanks for the question. I guess I'll start with just one on pet acquisition spend. It looks like you've spend a little bit more in the quarter relative to the prior quarter -- relative to 3Q. I know you had a little bit more success than maybe you expected then but you added still fewer pets on the subscription side this quarter. Just any comment around kind of what the moving parts were? And what you may have done a little bit different in this quarter versus prior would be helpful?

Darryl Rawlings -- President, Chief Executive Officer and Director

Sure. We mentioned last quarter in Q3 that we pulled back some of our test spending as we are a little bit tentative, but midway through the quarter to make sure that we remain cash flow positive. We kind of loosened that up in Q4 to allow some of that testing during the year. We really focused on kind of the internal rate of return for the entire year and kind of came in right at our target, actually on the high-end of our target.

Andrew Cooper -- Raymond James -- Analyst

Okay. That's helpful. And then as we think about 2019, I think you've mentioned maybe a little bit more aggressive on some of those test initiatives. Are there any in particular you can point us to? Or anything that you saw in 2018 that makes you feel better about kind of putting the pedal to the metal a little bit harder in that area?

Darryl Rawlings -- President, Chief Executive Officer and Director

Yeah, so at a high level in my opening remarks, I mentioned that -- last year, we had about $32 million in adjusted operating income. And we deployed about $24 million in the pet acquisition spend. In 2019, we expect that we're going to have about between $40 million and $45 million of adjusted operating income. And that's going to give us some opportunity to spend and deploy more capital.

Some of those areas are kind of proven areas and about 70% of our targeted spend is going to be in areas that we've got a high level of visibility, where we have high confidence, and strong internal rates of return, but 20% of what we spend are going to be things that, we have not yet fully optimized, but we see good trends and we have reasonably good visibility and about 10% is going to be kind of on high-level new testing. So I look at focus on those last 20% and 10%, we're going to be spending a lot more new money on conversion rates and using conversion rates both on the direct-to-consumer programs as well as kind of building out some more support mechanisms. That's probably the biggest area of change in 2019 over 2018.

Andrew Cooper -- Raymond James -- Analyst

Okay. That's helpful. I will hop back in the queue for now. Appreciate it.

Darryl Rawlings -- President, Chief Executive Officer and Director

Thank you.

Operator

Our next question comes from Jon Block, Stifel. Please proceed with your question.

Jon Block -- Stifel -- Analyst

Great. Thanks guys. Good afternoon. Trish or Darryl, I guess the question is about what's embedded in the guidance? Any details you can give on your gross subscriber thoughts in 2019? And I ask because they can't get a lot more difficult than 2019 versus 2018 than what you saw in 2017. I think you're up against roughly a 20% gross ad comp this year versus what was 4% or 5% in 2017. So, how should we think about that? And is sort of a 10% or 11% gross ad number the right place to be for 2019? And then I've got a follow-up.

Tricia Plouf -- Chief Financial Officer

Sure Jon. I'll give you as much visibility as I can. At a high level, the revenue guidance is based on the visibility that we have right now. If we have the opportunity to be more aggressive as we go through the year, we will do so and keep you updated. When it comes to total subscription enrolled pets, we would expect it to be pretty consistent with what we've seen in 2018 in terms of around that 15% growth level based on our guidance and pretty consistent retention rates as we've seen in 2018 as well which hopefully can help you back into the growth number that we've incorporated into our guidance at this time.

Jon Block -- Stifel -- Analyst

Okay. No, that certainly will help. And then Trish this one might be for you as well. But just relative to my model, the G&A looked a bit high from where we were. Obviously, you bought the building and I thought there would be some savings there and I'm thinking that would run through G&A maybe I'm mistaken. But was there anything that caught in the quarter or is that sort of almost annualized $20 million run rate the right one to use for G&A as we head into 2019?

Tricia Plouf -- Chief Financial Officer

Yes, I would say absent the building G&A, we would expect to increase modestly year-over-year to support our growth. You're right that we would have expected likely G&A to be more in line with past quarter. It's not a little bit better based on having a full quarter of the building running through. We did have some other expenses in G&A related to particularly accounting audit fees and some other professional services that were a bit of a step-up.

One example of that is this is the first year based on growth of our company we had to do a full external stocks' audit. And that was really weighted toward the back half of the year, particularly in Q4. So, that is the bigger of the expenses that did come through and was more heavily weighted in the fourth quarter to ensure we got through that successfully in the first year.

Jon Block -- Stifel -- Analyst

Okay. And last one for me. Darryl you mentioned a couple times in your prepared remarks that Canada you saw really good growth in and accelerated. I'm just curious if you can pinpoint why you saw that? Where there any particular programs that you initiated or kicked off that helped to accelerate the overall growth in Canada? Thanks guys.

Darryl Rawlings -- President, Chief Executive Officer and Director

Well, the reason we've kind of highlighted Canada, Canada we've been in the market for about 10 years ahead of the U.S. market and it gives us a really good forward look on acquisition growth rates retention rates all of the things that we can foreshadow what 2025 and 2028 is going to look like.

The Canadian business has been consistently growing. It's ticked-up a little bit. I think as we are pricing our subcategories a little bit more accurately that is the biggest area that we've seen a little bit of an increase in certain regions. But otherwise conversion rates and leads across Canada have all been strong.

Jon Block -- Stifel -- Analyst

Thank you.

Operator

Our next question comes from Mark Argento, Lake Street Capital Markets. Please proceed with your question.

Mark Argento -- Lake Street Capital Markets -- Analyst

Yeah. Hi. Good afternoon. Just a couple of quick questions. As we're modeling things out, can you help us better maybe in terms of some of the incremental spend or in terms of dollars, what do you think the incremental spend into the OpEx spend and the people some of the processes, can you help us quantify that, that would be helpful?

And then in terms of the product offering, I know you guys announced recently that you're insuring the pets now at the time of birth or very early on. What does that do to the business? Does that create a bigger opportunity for you guys? Any thoughts around that would be helpful. Thanks.

Tricia Plouf -- Chief Financial Officer

Hi, Mark. In regards to your first question in terms of people and processes, I'll talk about it in two buckets: one is, those related to the member experience and customer care and claims processing; and then the second one will be fixed expenses. When it comes to people and processes, we continue to invest in the member experience within sort of that our gross margin parameters of 18% to 21%.

That being said, as Darryl mentioned, we're really focused on trying to make incremental improvements in Nirvana in 2019. So if we do have the opportunity to incrementally invest in driving that, we likely will do so, and we'll speak more about that as we go through the year. But at a high level, making sure that those expenses grow in line with pets and revenue, so that we can support our members, which is consistent with the past is a priority.

In terms of fixed expenses, we will have a full year of the building benefit going through. Actually, we've mentioned in the past that will be slightly offset by making sure a lot of our teams are appropriately staffed to support our growth, while still driving a scale in fixed expenses.

And then within the pet acquisition team, that is the one that's a little bit more variable. And how much we spend in that area, which we think based on our revenue guidance could be around $30 million to $35 million at that data point. Those teams will grow as gross new pets grow as long as we're within the IRR guardrail.

Darryl Rawlings -- President, Chief Executive Officer and Director

And Mark, I think the other question was about us allowing pets to be enrolling at -- starting at the time of birth instead of eight weeks. Main reason we're doing that is to get alignment with breeders and to make sure that we can have the best customer experience for pet owners.

When you enroll somebody as young as possible, it means they don't have any pre-existing conditions. And that we can pay things really fast and quick and easy. So we don't see this as a major growth driver, we see it mostly around improving customer experience.

Mark Argento -- Lake Street Capital Markets -- Analyst

Great. And then just one follow-up. In terms of the non-subscription business, looks like you continue to have success in growing that business. Any thoughts around how that business might grow in 2019? Are you going to onboard additional white label partners there?

Darryl Rawlings -- President, Chief Executive Officer and Director

So at a high level kind of the guidance or feedback that Trish gave was that we expect the revenue to grow 20% to 25% for the year. These other areas, we have ongoing conversations. We've got different things that are in the pipeline, but they often take multiple years until we can get to a married state. And often it takes several years after that until it can have any meaningful impact on the company. So although, we're working on it, if there's anything new or exciting that we would change, we'd let the markets know about it at that time.

Mark Argento -- Lake Street Capital Markets -- Analyst

Thank you.

Operator

Our next question comes from Paul Penney, Northland Securities. Please proceed with your question.

Unidentified Participant -- -- Analyst

Good afternoon. This is Greg on for Paul. Thanks for taking my questions. First, are there any updates on the regulatory front? Is there anything that is maybe outside of the normal course of business that you're focused on maybe we should be concerned of?

Darryl Rawlings -- President, Chief Executive Officer and Director

No there's no changes on the regulatory front. As a background, we constantly have ongoing dialogue with different regulators. And we're not aware of anything that has any material impact on the business. And if we were, we would let the markets know about it.

I think at the higher level, we have very good strong alignment with regulators. We're trying to help build the category with transparency. The first company to cover congenital hereditary, we're trying to pay quickly and under minutes directly to the hospitals. We're trying to price more accurately by more subcategories and we're targeting higher payout rates. So what our goals are and the goals of the departments of insurance are very well aligned.

Unidentified Participant -- -- Analyst

Great. And then just with respect to the other revenue line item, can you just give a little bit more color on your efforts with respect to employee benefits or maybe other notable drivers in that category?

Darryl Rawlings -- President, Chief Executive Officer and Director

Yes, employee benefits is an area that we are building up our muscle on, but we don't see it as having a material growth impact in 2019 although we expect we're going to learn a lot more.

In 2018 and 2017 we've done a lot of testing. In 2019, we'll be taking some of the learnings and trying to implement it, so we can have a better experience for kind of be HR departments and some IT back end. But we don't expect it's going to be a big accelerator, although we think over the next 3, 4, 5 years it could be a interesting place for the category.

Unidentified Participant -- -- Analyst

Got it. Thank you.

Operator

Our next question comes from Kevin Ellich, Craig-Hallum. Please proceed with your question.

Kevin Ellich -- Craig-Hallum -- Analyst

I guess, I want to start off with lifetime value. It looks like it decreased 2.3% year-over-year to $710. I'm not sure, if I missed it Darryl, but did you guys talk about that yet? And could you give us any color as to the fluctuation that we're seeing now?

Darryl Rawlings -- President, Chief Executive Officer and Director

Yes. I mean ARPU is slightly up. So the way you calculate lifetime value, its ARPU, its margin and retention rates. We've got a little bit of a headwind as we've kind of increased the number of hospitals with our software by about 50%. That's about 1% decrease in our adjusted operating margin in a -- for a short period of time. So that's a little bit of a headwind and the other factors are about the same.

So I would expect that we will see modest progress on LVP over the next two to three years. So ARPU will help it go up. I expect retention rates will be relatively the same. Although as Trish mentioned, if we grow really fast our 90-day cancellation puts a little pressure on that.

Kevin Ellich -- Craig-Hallum -- Analyst

Okay. That's helpful. And then you gave some nice color about the test spend in some of the areas, we should be thinking about. What areas have you seen success in the past? And I guess, give us a little bit more background in terms of the strategic rationale for increasing that test spend?

Darryl Rawlings -- President, Chief Executive Officer and Director

Well what we're doing as a company is building relationships with veterinary clinics and trying to make it so that every time somebody walks into a veterinary clinic, they ask to check in who their medical insurance is with. And then if they have their software, they're able to answer the question the reason we ask is because they pay us directly, making the kind of more normalized. That on its own produces a higher and higher increased number of cost effective leads. But converting leads is always a challenge and will always continue to be a challenge.

So we need to be investing more and more money on when we get those leads how do we convert them and we're using more mobile platforms, we're using more bespoke conversations. And it's a different methods to a different person in a different region. So we're going to be investing more and more money on conversion. And we think there is good opportunity to do that. And outside of that I would really just say on a macro level, our adjusted operating income as I mentioned is expected to go to $40 million to $45 million. We'll be looking at spending $30 million to $35 million within our internal rates of return kind of in the midpoint of our range of 30% to 40%. So we've got more money to go out and test some of those areas.

Kevin Ellich -- Craig-Hallum -- Analyst

Got it. Okay. Yes, that makes sense. Two quick ones for me. Any update on the international expansion? And also how the food initiative is going? And then lastly, I thought there was an 8-K that was filed after the close. Looks like you have a board member who is not standing for reelection this year. Just wanted to see if you have an color as -- that you can provide as to what happened on that front?

Darryl Rawlings -- President, Chief Executive Officer and Director

Sure. Let's go international then food and then talk about board. So international, we will likely be issuing fresh policies in Australia over the next two to three months. We're about I would say 60 to 90 days slower than we would have been if you ask me a year ago and has mostly just been getting our ducks on their own paperwork done. Food initiative, we've got a team of people working on it. And we don't have a go-to-market strategy yet. But we're spending a lot of time and energy that team's working on how this impact.

But at the high level there, we believe that if pets eat a high-quality diet that they could have a better health outcome. And if they get a better health outcome, we could share that back with our clients. And then as you mentioned in the 8-K, Chad one of our audit chair is not -- is serving out his term, but will not be standing for reelection. He gave us a heads up about a year ago that he had other time commitments which we brought on Jackie another board member who will be stepping into the audit chair role when Chad steps down.

Kevin Ellich -- Craig-Hallum -- Analyst

Okay. Sounds good. Thank you.

Operator

(Operator Instructions) Our next question comes from Mark Mahaney, RBC Capital Markets. Please proceed with your question.

Mike Chen -- RBC Capital Markets -- Analyst

Hi, guys. Thanks for taking the question. This is Mike Chen on for Mark. In terms of your five key strategic initiatives, how would you rank the contribution of the initiatives, whether it's Trupanion Express that could result in incremental revenue in 2019 bringing you to the higher end of your guidance range? And then I was also wondering, if you can maybe give an update on Trupanion Express? How many hospitals it's rolled out to and progress with claims automation? Thanks.

Darryl Rawlings -- President, Chief Executive Officer and Director

Great question. So some of our growth -- accelerated growth in 2018 was driven by same-store sales initiatives and conversion rates. Conversion rates were up year-over-year. As I mentioned in the opening remarks, we're really pleased with that. Q4 was driven more by leads than conversion rates and with a small step down over Q3, but year-over-year up.

If you look at our claims automation, we're really pleased with the progress we're making. We think it's going to improve customer experience. We're going to talk a lot more about that at the shareholder letter -- shareholder meeting.

The other area is our adjusted operating margin, we've made decent progress during the year. That actually helps increase the allowable money that we can spend, because as the margin expands, our payback period shortens, allows us to be more aggressive on pet acquisition spend, while maintaining the same internal rate of return. And that gives a freedom to the team to push a little harder so that definitely helped.

And we'll go -- I plan on going over these in a lot more detail at the shareholder meeting, where the people and the team who are actually executing can talk to the crowd.

Mike Chen -- RBC Capital Markets -- Analyst

Got it. Thanks.

Operator

Our next question comes from Andrew Cooper, Raymond James. Please proceed with your question.

Andrew Cooper -- Raymond James -- Analyst

Hey, guys. Just one more quick one for me. I know awhile back I think at the shareholder meeting you talked about one region hitting Nirvana. I just wanted to get an update there? Is that sustained through the following quarters? And have you seen more regions reach that and sustain it? Or any sort of upgrade you could give there would be great. Appreciate it.

Darryl Rawlings -- President, Chief Executive Officer and Director

That -- our first region to hit Nirvana is still in Nirvana state, so we're excited. I'm not thrilled, because I can't announce that we have 10 or 20 others, but we've got a road map to work toward.

Andrew Cooper -- Raymond James -- Analyst

Great. Thanks.

Operator

Ladies and gentlemen, we have reached the end of the question-and-answer session. And this does conclude today's conference. You may disconnect your lines at this time. Thank you for your participation.

Duration: 54 minutes

Call participants:

Laura Bainbridge -- Investor Relation Contact Officer

Darryl Rawlings -- President, Chief Executive Officer and Director

Tricia Plouf -- Chief Financial Officer

Andrew Cooper -- Raymond James -- Analyst

Jon Block -- Stifel -- Analyst

Mark Argento -- Lake Street Capital Markets -- Analyst

Unidentified Participant -- -- Analyst

Kevin Ellich -- Craig-Hallum -- Analyst

Mike Chen -- RBC Capital Markets -- Analyst

Andrew Cooper -- Raymond James -- Analyst

More TRUP analysis

Transcript powered by AlphaStreet

This article is a transcript of this conference call produced for The Motley Fool. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript. As with all our articles, The Motley Fool does not assume any responsibility for your use of this content, and we strongly encourage you to do your own research, including listening to the call yourself and reading the company's SEC filings. Please see our Terms and Conditions for additional details, including our Obligatory Capitalized Disclaimers of Liability.

Rambus Inc. (NASDAQ:RMBS) Director David A. Shrigley sold 20,000 shares of the business’s stock in a transaction on Wednesday, February 20th. The stock was sold at an average price of $10.45, for a total value of $209,000.00. Following the sale, the director now owns 42,155 shares in the company, valued at approximately $440,519.75. The sale was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink.

Rambus Inc. (NASDAQ:RMBS) Director David A. Shrigley sold 20,000 shares of the business’s stock in a transaction on Wednesday, February 20th. The stock was sold at an average price of $10.45, for a total value of $209,000.00. Following the sale, the director now owns 42,155 shares in the company, valued at approximately $440,519.75. The sale was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink.  24/7 Wall St.

24/7 Wall St.

Birchcliff Energy (TSE:BIR) had its target price trimmed by TD Securities from C$7.50 to C$7.00 in a research report report published on Friday morning. The firm currently has an action list buy rating on the oil and natural gas company’s stock.

Birchcliff Energy (TSE:BIR) had its target price trimmed by TD Securities from C$7.50 to C$7.00 in a research report report published on Friday morning. The firm currently has an action list buy rating on the oil and natural gas company’s stock. Broadwind Energy Inc. (NASDAQ:BWEN) has been given a consensus broker rating score of 1.00 (Strong Buy) from the one brokers that provide coverage for the stock, Zacks Investment Research reports. One research analyst has rated the stock with a strong buy rating.

Broadwind Energy Inc. (NASDAQ:BWEN) has been given a consensus broker rating score of 1.00 (Strong Buy) from the one brokers that provide coverage for the stock, Zacks Investment Research reports. One research analyst has rated the stock with a strong buy rating.

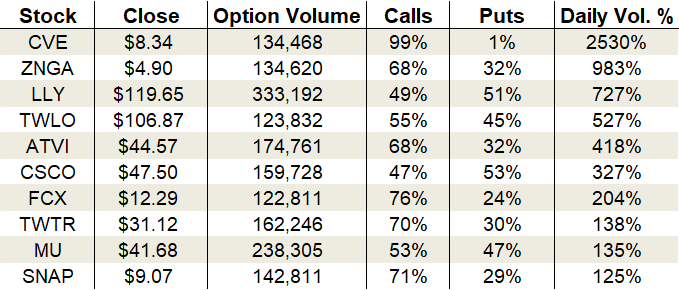

In the options pits, call buyers were busier than bears yesterday. Markets meandered higher while waiting for some geo-economic news. We still need President Donald Trump to actually sign the agreement to avert a U.S. government shutdown. This rally could disappear quickly if news on that front disappoints. Meanwhile, Wall Street still has one foot out the door. Investors will sell first and ask questions later. Regardless, the action was bullish since we had 18.9 million calls and 15.2 million puts during the session.

In the options pits, call buyers were busier than bears yesterday. Markets meandered higher while waiting for some geo-economic news. We still need President Donald Trump to actually sign the agreement to avert a U.S. government shutdown. This rally could disappear quickly if news on that front disappoints. Meanwhile, Wall Street still has one foot out the door. Investors will sell first and ask questions later. Regardless, the action was bullish since we had 18.9 million calls and 15.2 million puts during the session.