Demand for high-speed data is rapidly increasing. The shift to social networking and mobile devices in our lives has forced content providers to increasingly offer personalized data heavy content, including video, via high-speed networks to multiple access devices. There is also a transition underway in the corporate world. Cloud computing has changed the way businesses access the large amounts of data they use everyday. Now companies employ high-speed networks with Internet browsers or mobile devices to retrieve it on an as-needed basis.

Here are three companies making some significant changes in order to thrive in the new high-speed data environment:

Cisco Systems

Cisco (CSCO) is a leader in communications networking. It reported sales of $24.0 billion for the first six months of its fiscal year 2013, a modest 5.3% increase year-over-year. Concerning is that its core switching & router business, which accounts for about 60% of sales, showed no growth.

In response, the company is transitioning from a provider specializing in increasing network productivity to becoming one who also offers opportunities for improved revenue generation through high-speed access to enterprise data and securely delivered video entertainment. Cisco has made a couple of notable acquisitions to help them succeed in these areas.

In mid-2012, the company acquired NDS Group for about $5.0 billion. NDS was a leading provider of video software and content security solutions that enabled providers to securely deliver and monetize video entertainment. The acquisition of NDS is expected to accelerate the development of Cisco's own content delivery platform and expand into emerging markets such as China and India, where NDS has an established customer presence.

Cisco also recently acquired privately held Meraki Inc. for around $1.0 billion. Meraki offered customers networking solutions centrally managed from the cloud. With the purchase of Meraki, Cisco intends to expand its presence in cloud networking.

The company looks to have a fair business value, or cash earnings times a capitalization multiplier, of around $21 a share. This is based on expected sales of $48.0 billion and adjusted cash earnings at $8.1 billion. It also assumes a moderate-growth tech standard 14x multiplier. If Cisco can successfully penetrate the faster growing high-speed data markets, an elevated 16x multiplier might be considered.

ARRIS Group Inc.

ARRIS (ARRS) is a communications technology company that focuses on products that enable high-speed broadband transmission of video, telephony, and data. Most of the company's business is with cable TV system operators with Comcast and Time Warner Cableproviding about 50% of sales.

The company has produced some excellent results with revenues in the fourth quarter of 2012 at $344 million, around 22% higher than the fourth quarter of 2011 and the company's book-to-bill ratio, basically the ratio of orders received to orders shipped, in the fourth quarter 2012 was 1.11 as compared to 0.98 in last year's fourth quarter and 0.82 in the third quarter of 2012.

ARRIS is really changing its future with the planned acquisition of the Motorola Home business from Google. Motorola Home is a leading cable TV set-top box maker that generates around $3.4 billion in sales, more than double ARRIS Group's current revenue.

The purchase will be funded by $2.1 billion of debt and the issuance of about 21.2 million shares of stock. Because of the size of the purchase, significant transaction-related costs will be incurred but realization of efficiencies and cost cutting will probably provide a net benefit in the longer-term.

ARRIS is making a large transformative bet with the purchase. But it may have a meaningful payoff.

Prior to the Motorola Home purchase, ARRIS looks to have a fair business value of around $13 per share. This is based on a standard growing tech company 16x multiplier and expected sales of $1.4 billion and adjusted earnings at $95 million.

However, if the acquisition goes well and Motorola Home performs as it has done historically, the company is eventually expected to have revenues closer to $4.7 billion and cash earnings of $160 million. ARRIS would then have fair value nearer $18 with a 16x multiplier.

Conclusion

The increasing need for high-speed data is changing the world for both consumers and corporations. Tech companies able to successfully make this transition will be greatly rewarded; those that can't will be aptly punished. Investors in this space might want to keep a watchful eye on how their companies are playing this extremely important transformation.

| Currently 0.00/512345 Rating: 0.0/5 (0 votes) |

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS | Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

24.62 (1y: +2%) $(function(){var seriesOptions=[],yAxisOptions=[],name='CSCO',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1369976400000,24.115],[1370235600000,24.38],[1370322000000,24.36],[1370408400000,24.32],[1370494800000,24.55],[1370581200000,24.49],[1370840400000,24.36],[1370926800000,24.07],[1371013200000,23.99],[1371099600000,24.35],[1371186000000,24.09],[1371445200000,24.7],[1371531600000,24.82],[1371618000000,24.68],[1371704400000,24.435],[1371790800000,24.481],[1372050000000,24.055],[1372136400000,24.005],[1372222800000,24.385],[1372309200000,24.63],[1372395600000,24.335],[1372654800000,24.335],[1372741200000,24.32],[1372827600000,24.59],[1373000400000,24.57],[1373259600000,24.625],[1373346000000,25.155],[1373432400000,25.41],[1373518800000,25.87],[1373605200000,25.94],[1373864400000,25.93],[1373950800000,25.71],[1374037200000,25.72],[1374123600000,25.86],[1374210000000,25.82],[1374469200000,25.72],[1374555600000,25.56],[1374642000000,25.59],[1374728400000,25.5],[1374814800000,25.496],[1375074000000,25.33],[1375160400000,25.67],[1375246800000,25.59],[1375333200000,25.891],[1375419600000,26.19],[1375678800000,26.31],[1375765200000,26.21],[1375851600000,26.12],[1375938000000,26.26],[1376024400000,26.053],[1376283600000,26.34],[1376370000000,26.321],[1376456400000,26.377],[1376542800000,24.485],[1376629200000,24.27],[1376888400000,24.27],[1376974800000,24.32],[1377061200000,24.07],[1377147600000,24.01],[1377234000000,23.86],[1377493200000,23.83],[1377579600000,23.485],[1377666000000,23.445],[1377752400000,23.45],[1377838800000,23.31],[1378184400000,23.48],[1378270800000,23.77],[1378357200000,23.69],[1378443600000,23.55],[1378702800000,23.92],[1378789200000,24.155],[1378875600000,24.375],[1378962000000,24.29],[1379048400000,24.32],[1379307600000,24.38],[1379394000000,24.37],[1379480400000,24.795],[1379566800000,24.615],[1379653200000,24.51],[1379912400000,24.275],[1379998800000,24.14],[1380085200000,24.43],[1380171600000,23.77],[1380258000000,23.33],[1380517200000,23.431],[1380603600000,23! .24],[1380690000000,23.32],[1380776400000,23.005],[1380862800000,23.02],[1381122000000,22.89],[1381208400000,22.635],[1381294800000,22.5],[1381381200000,23.01],[1381467600000,23.28],[1381726800000,23.34],[1381813200000,23.18],[1381899600000,22.995],[1381986000000,22.781],[1382072400000,22.961],[1382331600000,22.93],[1382418000000,22.65],[1382504400000,22.255],[1382590800000,22.375],[1382677200000,22.455],[1382936400000,22.55],[1383022800000,22.825],[1383109200000,22.705],[1383195600000,22.56],[1383282000000,22.565],[1383544800000,22.58],[1383631200000,23.065],[1383717600000,23.28],[1383804000000,23.11],[1383890400000,23.51],[1384149600000,23.445],[1384236000000,23.73],[1384322400000,23.995],[1384408800000,21.365],[1384495200000,21.535],[1384754400000,21.29],[1384840800000,21.42],[1384927200000,21.23],[1385013600000,21.47],[1385100000000,21.46],[1385359200000,21.27],[1385445600000,21.21],[1385532000000,21.27],[1385704800000,21.25],[1385964000000,21.09],[1386050400000,21.26],[1386136800000,21.249],[1386223200000,20.91],[1386309600000,21.28],[1386568800000,21.22],[1386655200000,21.21],[1386741600000,20.88],[1386828000000,20.51],[1386914400000,20.24],[1387173600000,20.68],[1387260000000,20.92],[1387346400000,21],[1387432800000,21.07],[1387519200000,21.13],[1387778400000,21.57],[1387864800000,21.69],[1388037600000,21.8],[1388124000000,22.02],[138

24.62 (1y: +2%) $(function(){var seriesOptions=[],yAxisOptions=[],name='CSCO',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1369976400000,24.115],[1370235600000,24.38],[1370322000000,24.36],[1370408400000,24.32],[1370494800000,24.55],[1370581200000,24.49],[1370840400000,24.36],[1370926800000,24.07],[1371013200000,23.99],[1371099600000,24.35],[1371186000000,24.09],[1371445200000,24.7],[1371531600000,24.82],[1371618000000,24.68],[1371704400000,24.435],[1371790800000,24.481],[1372050000000,24.055],[1372136400000,24.005],[1372222800000,24.385],[1372309200000,24.63],[1372395600000,24.335],[1372654800000,24.335],[1372741200000,24.32],[1372827600000,24.59],[1373000400000,24.57],[1373259600000,24.625],[1373346000000,25.155],[1373432400000,25.41],[1373518800000,25.87],[1373605200000,25.94],[1373864400000,25.93],[1373950800000,25.71],[1374037200000,25.72],[1374123600000,25.86],[1374210000000,25.82],[1374469200000,25.72],[1374555600000,25.56],[1374642000000,25.59],[1374728400000,25.5],[1374814800000,25.496],[1375074000000,25.33],[1375160400000,25.67],[1375246800000,25.59],[1375333200000,25.891],[1375419600000,26.19],[1375678800000,26.31],[1375765200000,26.21],[1375851600000,26.12],[1375938000000,26.26],[1376024400000,26.053],[1376283600000,26.34],[1376370000000,26.321],[1376456400000,26.377],[1376542800000,24.485],[1376629200000,24.27],[1376888400000,24.27],[1376974800000,24.32],[1377061200000,24.07],[1377147600000,24.01],[1377234000000,23.86],[1377493200000,23.83],[1377579600000,23.485],[1377666000000,23.445],[1377752400000,23.45],[1377838800000,23.31],[1378184400000,23.48],[1378270800000,23.77],[1378357200000,23.69],[1378443600000,23.55],[1378702800000,23.92],[1378789200000,24.155],[1378875600000,24.375],[1378962000000,24.29],[1379048400000,24.32],[1379307600000,24.38],[1379394000000,24.37],[1379480400000,24.795],[1379566800000,24.615],[1379653200000,24.51],[1379912400000,24.275],[1379998800000,24.14],[1380085200000,24.43],[1380171600000,23.77],[1380258000000,23.33],[1380517200000,23.431],[1380603600000,23! .24],[1380690000000,23.32],[1380776400000,23.005],[1380862800000,23.02],[1381122000000,22.89],[1381208400000,22.635],[1381294800000,22.5],[1381381200000,23.01],[1381467600000,23.28],[1381726800000,23.34],[1381813200000,23.18],[1381899600000,22.995],[1381986000000,22.781],[1382072400000,22.961],[1382331600000,22.93],[1382418000000,22.65],[1382504400000,22.255],[1382590800000,22.375],[1382677200000,22.455],[1382936400000,22.55],[1383022800000,22.825],[1383109200000,22.705],[1383195600000,22.56],[1383282000000,22.565],[1383544800000,22.58],[1383631200000,23.065],[1383717600000,23.28],[1383804000000,23.11],[1383890400000,23.51],[1384149600000,23.445],[1384236000000,23.73],[1384322400000,23.995],[1384408800000,21.365],[1384495200000,21.535],[1384754400000,21.29],[1384840800000,21.42],[1384927200000,21.23],[1385013600000,21.47],[1385100000000,21.46],[1385359200000,21.27],[1385445600000,21.21],[1385532000000,21.27],[1385704800000,21.25],[1385964000000,21.09],[1386050400000,21.26],[1386136800000,21.249],[1386223200000,20.91],[1386309600000,21.28],[1386568800000,21.22],[1386655200000,21.21],[1386741600000,20.88],[1386828000000,20.51],[1386914400000,20.24],[1387173600000,20.68],[1387260000000,20.92],[1387346400000,21],[1387432800000,21.07],[1387519200000,21.13],[1387778400000,21.57],[1387864800000,21.69],[1388037600000,21.8],[1388124000000,22.02],[138

Popular Posts: 3 More Conglomerates to Own3 Companies That Burn Cash Worse than the New York YankeesBuild a Retirement Plan With Just 7 ETFs Recent Posts: 3 Soaring Stocks That Are Beating the Odds Build a Retirement Plan With Just 7 ETFs Mine the Bakken Oil Surge: ETF Alternatives for Hot Stock Picks View All Posts

Popular Posts: 3 More Conglomerates to Own3 Companies That Burn Cash Worse than the New York YankeesBuild a Retirement Plan With Just 7 ETFs Recent Posts: 3 Soaring Stocks That Are Beating the Odds Build a Retirement Plan With Just 7 ETFs Mine the Bakken Oil Surge: ETF Alternatives for Hot Stock Picks View All Posts  Between the current government shutdown and looming debt ceiling crisis, it’s almost no wonder stock have been showing some weakness of late. From Sept. 18 until Oct. 8, the Dow Jones Industrial Average shed nearly 6%, while the S&P 500 fell 4%.

Between the current government shutdown and looming debt ceiling crisis, it’s almost no wonder stock have been showing some weakness of late. From Sept. 18 until Oct. 8, the Dow Jones Industrial Average shed nearly 6%, while the S&P 500 fell 4%. Year-to-Date Return: 44%

Year-to-Date Return: 44% Year-to-Date Gains: 77%

Year-to-Date Gains: 77% Year-to-Date Gains: 100%

Year-to-Date Gains: 100% Matthew Staver/Bloomberg via Getty Images WASHINGTON -- More Americans signed contracts to purchase homes in April than the prior month. But the pace of buying is still weaker than last year, as higher prices and relatively tight supplies have limited sales. The National Association of Realtors said Thursday that its seasonally adjusted pending home sales index rose 0.4 percent to 97.8 last month. The index remains 9.2 percent below its level a year ago. Pending sales are a barometer of future purchases. A one- to two-month lag usually exists between a signed contract and a completed sale. The index indicates that home buying has barely increased in May. The gain in signed contracts partly reflects the slight decline in mortgage rates and the economic rebound from the brutal winter. But prices have risen by 12.4 percent year-over-year, according to Standard & Poor's/Case-Shiller 20-city home price index. That has put home ownership out of reach for a growing share of Americans who are stuck with stagnant incomes in the aftermath of the Great Recession. The number of signed contracts increased in the Northeast and Midwest month-to-month, suggesting that a modest weather-based rebound has occurred. However, pending sales dropped last month in the West and South, a sign to many economists that the price increases have muted buying activity more than nasty weather. "The end of the severe winter weather will not bring with it a sustained revival in the housing market," said Ian Shepherdson, chief economist at Pantheon Macroeconomics. "The real problem is last year's massive deterioration in affordability." Would-be buyers have gotten some help in recent weeks from falling mortgage rates. Average rates for 30-year, fixed mortgages declined for the fifth straight week to 4.12 percent, according to mortgage buyer Freddie Mac. Still, rates remain above their lows of 3.51 percent a year ago. The rising rates in the second half of 2013 and higher home prices appear to have reduced the pool of potential homebuyers. The Realtors said last week that sales rose 1.3 percent in April from March to a seasonally adjusted annual rate of 4.65 million. Purchases of homes over the past 12 months have dropped 6.8 percent.

Matthew Staver/Bloomberg via Getty Images WASHINGTON -- More Americans signed contracts to purchase homes in April than the prior month. But the pace of buying is still weaker than last year, as higher prices and relatively tight supplies have limited sales. The National Association of Realtors said Thursday that its seasonally adjusted pending home sales index rose 0.4 percent to 97.8 last month. The index remains 9.2 percent below its level a year ago. Pending sales are a barometer of future purchases. A one- to two-month lag usually exists between a signed contract and a completed sale. The index indicates that home buying has barely increased in May. The gain in signed contracts partly reflects the slight decline in mortgage rates and the economic rebound from the brutal winter. But prices have risen by 12.4 percent year-over-year, according to Standard & Poor's/Case-Shiller 20-city home price index. That has put home ownership out of reach for a growing share of Americans who are stuck with stagnant incomes in the aftermath of the Great Recession. The number of signed contracts increased in the Northeast and Midwest month-to-month, suggesting that a modest weather-based rebound has occurred. However, pending sales dropped last month in the West and South, a sign to many economists that the price increases have muted buying activity more than nasty weather. "The end of the severe winter weather will not bring with it a sustained revival in the housing market," said Ian Shepherdson, chief economist at Pantheon Macroeconomics. "The real problem is last year's massive deterioration in affordability." Would-be buyers have gotten some help in recent weeks from falling mortgage rates. Average rates for 30-year, fixed mortgages declined for the fifth straight week to 4.12 percent, according to mortgage buyer Freddie Mac. Still, rates remain above their lows of 3.51 percent a year ago. The rising rates in the second half of 2013 and higher home prices appear to have reduced the pool of potential homebuyers. The Realtors said last week that sales rose 1.3 percent in April from March to a seasonally adjusted annual rate of 4.65 million. Purchases of homes over the past 12 months have dropped 6.8 percent.

Popular Posts: Hottest Technology Stocks Now – ASX DDD HIMX CDNS7 Biotechnology Stocks to Buy NowHottest Healthcare Stocks Now – CLVS CYH AZN MNKD Recent Posts: Hottest Healthcare Stocks Now – PRXL ALXN ACHC HMSY Biggest Movers in Financial Stocks Now – HOMB GBL RATE HTH Biggest Movers in Technology Stocks Now – WBMD ATHN ULTI ZNGA View All Posts

Popular Posts: Hottest Technology Stocks Now – ASX DDD HIMX CDNS7 Biotechnology Stocks to Buy NowHottest Healthcare Stocks Now – CLVS CYH AZN MNKD Recent Posts: Hottest Healthcare Stocks Now – PRXL ALXN ACHC HMSY Biggest Movers in Financial Stocks Now – HOMB GBL RATE HTH Biggest Movers in Technology Stocks Now – WBMD ATHN ULTI ZNGA View All Posts  www.netflix.com From a fast-growing maker of luxury purses hoping to bag another blowout quarter to the country's leading streaming video service rolling out another exclusive series, here are some of the things that will help shape the week that lies ahead on Wall Street. Monday -- We Remember It's Memorial Day, and that means that all of the stateside exchanges are closed. Of course, there will be international stocks trading. But whether you honor the spirit of the Memorial Day holiday or just see it as the start of summer and a good excuse to fire up the barbecue, there's no reason to be glued to CNBC. Your investments can wait. Tuesday -- Checking Under the Hood The auto parts industry has proven to be an all-weather niche. When the economy's humming along, folks are spending money on their cars. When the economy's in a funk, drivers hold on to their cars longer, and that requires more money invested in maintaining their aging vehicles. It's against this backdrop that AutoZone (AZO) reports quarterly results on Tuesday morning. Analysts see sales climbing 6 percent higher with earnings per share soaring 16 percent. The 4,871-store chain has beaten Wall Street's profit targets every quarter over the past year, so let's not assume that analysts are being generous with their forecasts. Wednesday -- Kors of Action Michael Kors (KORS) continues to be the growth darling when it comes to luxury handbags. As the iconic Coach (COH) has struggled, Kors has taken market share with its fashionable purses, satchels and other accessories. It's not even close. Analysts see Coach's sales declining 6 percent for its fiscal year ending in June. Wall Street sees Kors growing its business by 47 percent for its fiscal year that ended in March. We'll know for sure how Kors wrapped up fiscal 2014 when it reports on Wednesday. Thursday -- Big Savings in Bulk Another retailing niche that has seemed to have the same all-weather appeal as auto parts is the warehouse club market. Shoppers relish buying quality supermarket products in bulk, and that resonates when times are well but also plays well when consumers need to stretch a dollar. Costco (COST) is the poster child for warehouse clubs, and it reports on Thursday. Investors shouldn't hold out for spectacular growth. That's not what Costco does. Investors flock to the stock because of its steady performance, and on Thursday the market expects to see sales clock in 7 percent higher for its latest quarter with a 5 percent uptick in earnings. Friday -- Now Streaming Netflix (NFLX) has achieved great success with its streaming service by landing original content. "House of Cards," "Orange Is the New Black" and the revival of "Arrested Development" have made Netflix a valuable digital platform. One of last year's shows that didn't generate the same kind of buzz was Ricky Gervais' "Derek." Whether it was the notoriety surrounding the lead character's mentally challenged ways or just that the show originally aired on BBC, it wasn't one of Netflix's biggest additions. However, Netflix doesn't give up easily. The second season of "Derek" premieres on Netflix come Friday. More from Rick Aristotle Munarriz

www.netflix.com From a fast-growing maker of luxury purses hoping to bag another blowout quarter to the country's leading streaming video service rolling out another exclusive series, here are some of the things that will help shape the week that lies ahead on Wall Street. Monday -- We Remember It's Memorial Day, and that means that all of the stateside exchanges are closed. Of course, there will be international stocks trading. But whether you honor the spirit of the Memorial Day holiday or just see it as the start of summer and a good excuse to fire up the barbecue, there's no reason to be glued to CNBC. Your investments can wait. Tuesday -- Checking Under the Hood The auto parts industry has proven to be an all-weather niche. When the economy's humming along, folks are spending money on their cars. When the economy's in a funk, drivers hold on to their cars longer, and that requires more money invested in maintaining their aging vehicles. It's against this backdrop that AutoZone (AZO) reports quarterly results on Tuesday morning. Analysts see sales climbing 6 percent higher with earnings per share soaring 16 percent. The 4,871-store chain has beaten Wall Street's profit targets every quarter over the past year, so let's not assume that analysts are being generous with their forecasts. Wednesday -- Kors of Action Michael Kors (KORS) continues to be the growth darling when it comes to luxury handbags. As the iconic Coach (COH) has struggled, Kors has taken market share with its fashionable purses, satchels and other accessories. It's not even close. Analysts see Coach's sales declining 6 percent for its fiscal year ending in June. Wall Street sees Kors growing its business by 47 percent for its fiscal year that ended in March. We'll know for sure how Kors wrapped up fiscal 2014 when it reports on Wednesday. Thursday -- Big Savings in Bulk Another retailing niche that has seemed to have the same all-weather appeal as auto parts is the warehouse club market. Shoppers relish buying quality supermarket products in bulk, and that resonates when times are well but also plays well when consumers need to stretch a dollar. Costco (COST) is the poster child for warehouse clubs, and it reports on Thursday. Investors shouldn't hold out for spectacular growth. That's not what Costco does. Investors flock to the stock because of its steady performance, and on Thursday the market expects to see sales clock in 7 percent higher for its latest quarter with a 5 percent uptick in earnings. Friday -- Now Streaming Netflix (NFLX) has achieved great success with its streaming service by landing original content. "House of Cards," "Orange Is the New Black" and the revival of "Arrested Development" have made Netflix a valuable digital platform. One of last year's shows that didn't generate the same kind of buzz was Ricky Gervais' "Derek." Whether it was the notoriety surrounding the lead character's mentally challenged ways or just that the show originally aired on BBC, it wasn't one of Netflix's biggest additions. However, Netflix doesn't give up easily. The second season of "Derek" premieres on Netflix come Friday. More from Rick Aristotle Munarriz Colombia's upcoming presidential run-off will impact the country's peace talks with rebels. (Photo credit: adrimcm)

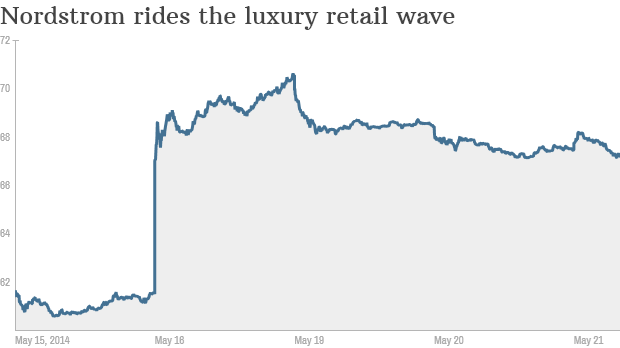

Colombia's upcoming presidential run-off will impact the country's peace talks with rebels. (Photo credit: adrimcm) All about the bling! Tiffany shines NEW YORK (CNNMoney) Catering to the one percent has its perks. Just look at the recent performance of luxury retail stocks.

All about the bling! Tiffany shines NEW YORK (CNNMoney) Catering to the one percent has its perks. Just look at the recent performance of luxury retail stocks.

Derek Gordon/Shutterstock

Derek Gordon/Shutterstock