When analyzed from a quantitative perspective, Micron (MU) looks like a compelling investing idea. The stock is clearly cheap, and the business is reporting solid financial performance. However, uncertainty about pricing in the DRAM and NAND markets is a major risk factor for investors in Micron.

In order to mitigate those risks while still capturing some upside potential in Micron, the following paragraphs will be introducing 3 different options trades ideas based on Micron.

Micron Stock: Opportunity And RiskLooking at the numbers, Micron stock seems to be offering plenty of upside potential from current levels. The company reported impressive financial performance last quarter, with revenue growing 58% versus the same quarter in the prior year and reaching $7.3 billion. In addition, the company retained 48.5% of revenue as operating profit during the period.

In spite of this, valuation remains remarkably low. Wall Street analysts are on average expecting the company to make $9.85 in earnings per share next year. Under this assumption, Micron stock is trading at bargain-low forward price to earnings ratio of 5.4 times earnings expectations.

This valuation is arguably due to pricing uncertainty in the company's main markets. According to data from Notable Calls, market dynamics for DRAM products are deteriorating rapidly. On the other hand, some Wall Street analysts remain aggressively bullish on the stock; on May 17 RBC Capital initiated coverage on Micron with a price target of $80. This implies a massive upside potential of almost 50% from current price levels.

Micron stock is basically an investment alternative with high risk and elevated potential returns. If pricing in the DRAM market remains relatively healthy, the stock could deliver huge returns for investors going forward. However, the industry is notoriously volatile and uncertain, and this uncertainty is weighting on the stock.

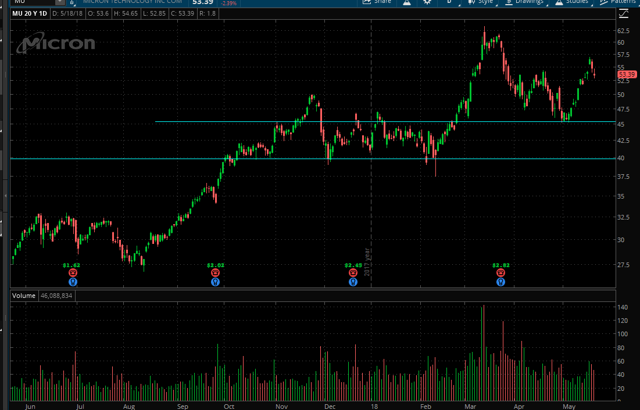

In terms of price action, Micron is up by almost 30% in the last 12 months, but the stock is moving mostly sideways in the past several months. Micron stock made new highs at around $62 per share in March, and it seems to have well-defined support levels at around $45 and $40 per share.

Options Trade Idea 1: Bull Call Spread

Options Trade Idea 1: Bull Call Spread The bullish case for Micron is easy to see. If you believe that fears about falling DRAM prices are exaggerated, then it makes a lot of sense to make a strong bullish play on Micron. From that point of view, a bull call spread looks like an interesting idea.

For example, you can buy the call contract with a strike price of $53 expiring on June 29 and sell the call contract with the same expiry date and a strike price of $65. Based on prices at the midd-point of the bid and ask quotes, that spread would have a total cost of $345 per contract.

The maximum loss in this case is obviously the cost of the contract, and investors can gain as much as $855 per contract if Micron stock is above $65 on June 29. In percentage terms, this would mean a juicy gain of 247.83% in only 40 days.

The breakeven stock price for this strategy is $56.45 per share, so you need the stock to move upwards in order to make money from this trade.

Options Trade Idea 2: Covered CallA covered call is a more conservative play, allowing investors to generate recurrent income from a position in Micron stock in exchange for a reduced upside potential in the position.

For example, buying 100 shares in Micron at a current price of $53.4 and selling the June 29 call with a strike price of $65 would generate $75 in premiums. This is a raw return of 1.4% in 40 days, which means an annualized yield of 12.8%.

As long as the stock remains above $52.53 per share this position remains above breakeven, so it's a smart way to reduce the effective entry cost when betting on Micron stock.

This is a good alternative for investors who want to own the stock and also want to be well rewarded for their patience by generating income from such position.

Options Trade Idea 3: Bull Put SpreadAnother possibility would be a bull put spread. For example, selling the June 29 put contract with a strike price of $50 and buying the put contract with the same expiry date and a strike price of $46 would generate a cash entry of $112 per contract at current prices.

The maximum possible loss would be $288, which doesn't sound very exciting in comparison to a maximum possible gain of $112. However, based on historical volatility levels for the stock the chance of success in this strategy is above 65.2%. This strategy makes money as long as Micron stock remains above $48.88 by the options expiry date.

A bull put spread makes sense for those who believe that the main risks in Micron are already reflected on valuation and that the downside risk in the stock is limited.

Capitalize on the power of data and technology to take the guesswork out of your investment decisions. Statistical research has proven that stocks and ETFs showing certain quantitative attributes tend to outperform the market over the long term. A subscription to The Data Driven Investor provides you access to profitable screeners and live portfolios based on these effective and time-proven return drivers. Forget about opinions and speculation, investing decisions based on cold hard quantitative data can provide you superior returns with lower risk. Click here to get your free trial now.

Disclosure: I am/we are long MU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment