On Wednesday, June 18, the FOMC will release both its Economic Projections and Statement. The FOMC Statement usually results in a volatile market. However, when both the Economic Projections and Statements are released together, the result is a more volatile and stronger movement.

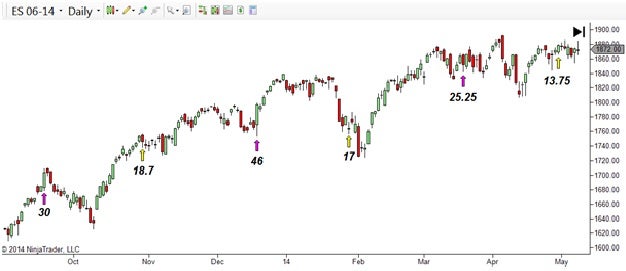

For example, on the chart below, the yellow arrows highlight the release of the FOMC statement only and the magenta arrows highlight when the FOMC releases the Economic Projections with the Statement. The total movement from low to high, in points, for each release is below the arrows.

By comparing the two, the market volatility is almost double when the FOMC releases both at the same (also known as a double whammy).

Going down in time to a sixty minute chart for each of the FOMC Projections and Statement release days, the chart shows that most of the movement for the day was immediately after the announcements.

The issues in trading these movements are:

·Often, instead of using technical analysis, a trader may base their trade on an opinion and everyone has a different opinion of what will happen.

·A trader may dismiss their money management rules, thereby exposing the trading account to huge risk.

·A trader may use technical analysis, realize the direction to which the market is skewed, but fail to pull the trigger on the trade because of fear of a loss.

·A trader may manage to enter in the right direction and make a profit, but decide they exited too early and jump back in just as the market either completes the move or reverses. Whatever profits they may have made would be given back

By the end of the day, any trader can be an emotional wreck. The volatile movement causes an adrenaline rush. Then the losses or lack of entry causes the trader to question why they jumped back in or failed to enter at all. The next day can be just as painful as a trader may still be caught up in the emotional rollercoaster of the previous day.

Is there a way to prevent the psychological trauma and successfully trade the FOMC announcements? Yes, a trader can prevent the psychological trauma and successfully trade the FOMC announcements by using binary options and spreads.

Using binary options, traders can incorporate their technical analysis techniques and decide if price will be greater than or less than a pre-defined price by the close of the day. Then they may simply choose a strike price and pay the premium, which caps potential loss. Instead of exposing entire accounts to loss, losses are limited to the premium paid for the option.

Take for example, the last FOMC double release on March 19, 2014. At that time, the price was testing the high at 1867.50. As this test was occurring, the volume was diverging (black lines highlight the volume bars and show they were decreasing as the test occurs). The only low in this series highlighted by the red line, shows that sellers were entering the market (increasing volume). Using volume as a leading indicator, a trader can place a strike for price to be less than the high at 1867.50.

Since price was at the money at the time a trader placed the trade, the typical risk would be approximately fifty dollars per contract. This method enables traders to use logical thinking skills to plan the trade, limit risk, and enter the trade knowing that trading plans and money management guidelines were followed.

Although traders may still have the adrenaline rush (volatile movements tend to create the fight or flight state of mind), it is easier on traders’ mental and psychological states knowing that risk is limited and that the trades were thought through ahead of time. Using this binary option methodology, a trader can maintain as much control over their trade as possible, and they are not at the mercy of the markets.

Another example is for traders to use both a long and short spread (these are offered by Nadex Binary Options and Spreads). In this scenario, traders search for the closest prices to 1867.50 using both a floor and a ceiling with expirations at 4 pm ET. They can short the ceiling and buy the floor. The risk is limited to the difference between the entry and the ceiling or floor.

These spreads are offered on a daily basis, as well as every two hours. Therefore, traders can check both to see which expiration offers the lowest risk. Again, even though traders may feel the adrenaline rush, they can be confident that risk is limited regardless of the upcoming market direction.

Both of the above examples encourage use of a logical and methodical approach to trading volatile market movements, instead of listening t

No comments:

Post a Comment